The outlook for Emerging Markets (EM) corporate bonds in hard currencies in 2025 is cautiously optimistic, supported by an attractive yield and a low projected default rate given strong fundamentals.

We balance the fund to selectively take advantage of the high carry, which offers good income potential, while carefully considering market conditions and issuer fundamentals in this context of relatively compressed risk premia.

I. Review of emerging markets corporate bonds in 2024

2024 was a challenging year for global fixed income markets. On the rate side, despite the long-awaited inception of the US Fed easing cycle – that led to a cumulative 100 bps reduction in Fed fund rates since September, initial expectations for lower US Treasury yields did not materialize.

Over 2024, the US Treasury 10-year yields rose by 69 bps (92 bps since the first Fed rate cut in September), as the confirmation of US exceptionalism in terms of economic growth and the stagnation of core inflation at around 3% advocate for greater caution regarding the future path of the monetary cycle and support the view that rates could remain higher for longer.

10-year yields ended the year higher for the fourth consecutive year, at 4.57%. This in turn led to poor performance for US Treasuries, with the 10-year T-notes returning -1.7% in 2024 and -2.5% in the second half of the year.

For 2025, according to the dot plot released after the December meeting, only two 25 bps rate cuts are now expected, compared with four projected after the September meeting, and while we write this outlook, the market expectation for 10-year rates at the end of 2025 stands at 4.16%.

EM hard-currency corporate bond market was the sweet spot within EM fixed income in 2024

Meanwhile, EM hard-currency bonds delivered sound returns in 2024, mostly driven by a 60-70 bps spread compression throughout the year and a normalizing default rate (cf. below). EM sovereign debt (EMBIG Div) delivered a +6.5% return in 2024, while EM corporate debt (CEMBI Broad Div) achieved +7.6% in the same period in dollar terms (+5.9% euro-hedged).

Looking at the second half of the year alone as we launched our fund in the end of the first semester, EM sovereign debt returned +4.1% while EM corporate debt achieved a +3.6% return. As of December 31, 2024, the fund had a net asset value of 1062.32 for the AC USD share class and 1050.10 for the AC EUR share class.

EM local currency bonds faced a tougher backdrop, ending the year down 2.4% in dollar terms, including carry. The combination of a strengthening dollar and fiscal challenges in some regions pressured local currencies.

High Yield (HY) outperformed Investment Grade (IG) in the emerging markets corporate debt market. While EM IG corporate debt returned +5.1% in 2024 (H2: +2.8%), the EM HY corporate debt market returned a much higher +11.7% for the year (H2: +4.9%).

The outperformance of HY was driven by lower duration, low default rates, higher carry, a broad reopening of primary markets that allowed for successful refinancings, and a steeper spread compression for the segment, especially in the first half of the year. Spread compression reached 116 bps for the HY (38 bps in H2) against 44 bps for the IG (14 bps in H2).

Ahead of 2025, we think that EM hard-currency corporate bonds are still more attractive on a risk-adjusted basis and remain the place to be in the long run within the EM fixed income universe. Corporate defaults are expected to remain low at 1.7% (for the CEMBI Broad Div HY index), and we expect primary markets to be quite active early in the year for EM issuers.

While local currency pressures and broad dollar strength could continue in 2025, we think that some of the large losers of 2024, such as domestic BRL-denominated bonds (-22% in USD), could, however, revert part of their loss in 2025.

Disparity across regions within the EM universe

As always, the diversity of the EM investment universe led to uneven returns between regions and countries, rewarding sound bond-picking strategies. Looking at the different regions, Africa turned out to be the best-performing region (+11.3%), mostly driven by its higher concentration of HY bonds.

Nigeria was the strongest performer in the continent, with Nigerian corporates returning +15.0% in 2024 on the back of a positive reform momentum and improving macro conditions under the new Tinubu administration.

We have been mostly overweight on Nigerian corporates throughout H2 and we still see some compelling credit stories in other African countries.

Notably, the main contributor to the fund’s performance in 2024 was the South-African fiber optics company Liquid Telecom, whose bonds rose almost 25% in the second half of the year, driven by improving operational performance, the completion of a significant capital injection – involving the US Development Finance Corporation and Google – and the refinancing of part of its debt.

Emerging Europe returned +10.8% in 2024, mostly benefiting from the strong performance of Ukrainian corporates (+32.6%), which were boosted by optimistic market assumptions regarding a peaceful resolution to the conflict.

We see potential hurdles to this possible outcome that we feel are not fully priced in by the market. Trump himself has extended his timing for resolution from 24 hours to 6 months. We took some profit from our investments in the region as we seek greater clarity on the peace process to justify current spread levels.

Turkey returned a sound +9.9% in 2024 as well, thanks to spread compression helped by normalizing monetary policy and decelerating inflation. Primary activity was particularly strong in Turkey in 2H24, with both new and existing issuers seizing the opportunity to price new transactions in the markets to raise new money or roll their debt.

Latin America returned +8.7% in 2024. Argentine was the best-performing country in the region in 2024, with a return of +18.6% for Argentine corporates. Fiscal concerns in Brazil (+7.1%) and the likely impact of US trade and deportation policies on Mexico after the US election (+5.0%) weighed on the region’s performance.

Colombia performed well (+9.2%), with corporate issuers’ performance benefiting from higher country risk premium following the election of Petro and the loss of its Investment Grade sovereign rating in 2022, making Colombian hard-currency corporate debt an attractive risk/reward opportunity within EM corporate debt markets.

Spreads on Colombian corporates are still at an attractive 404 bps for a crossover(BBB/BB) country, with almost no tightening observed in H2, while default rates have remained near 0% since 2021 in the country.

Asia posted a +6.8% return in 2024, boosted by the strong performance of the Philippines (+10.8%), India and Indonesia (+8.3% for both).

Asia HY performed particularly well (+12.5%) due to the China property HY sector posting a +20.7% for the year. However, this comes after several years of significantly negative returns and ongoing uncertainty about the fate of the sector.

Asia regional spreads are the second lowest after Middle-East – which is largely IG-weighted – with spreads at only 211 bps and a steep 78 bps tightening in 2024, while it remains the primary bucket of defaults in recent years due to China. We remain upbeat on Indian corporate fundamentals but tight spreads and ESG-related issues explain our underexposure, while we still are structurally underweight on China given low transparency, (geo)political risk and tight valuations.

Middle East was the weakest performer (+5.3%), mostly due to a high concentration of IG-rated bonds with longer durations.

II. What to expect from emerging markets corporate bonds for 2025?

As we enter 2025, yields on EM corporate bonds remain attractive compared with historical levels, standing at 9.7% for our fund at the end of the year following the December rate sell-off. Regarding Fed funds rates, the market was forecasting only 40 bps of cuts for 2025 as we speak, down from 80 bps in November.

After the sell-off observed since mid-December, we believe that inflationary risks suggested by recent macroeconomic data are already priced in by the markets, which makes us more confident in cautiously adding some duration to our portfolio.

We remain cautious as we recognize that incoming inflation and US macro data, as well as the uncertainty introduced by future Trump policies, may bring additional volatility throughout the year.

Regarding credit premia, while EM spreads are below historical average, this partly reflects the crisis-driven distortions of 2020 and 2022. Looking at spreads over the last 10 years, while both US IG and US HY spreads are already at their 10-year tights, EM corporate debt is still above its 2018 tights in the HY segment.

Indeed, EM HY spreads remain approx. 65 bps above their 10-year tights of 2018, while EM corporate credit fundamentals have meaningfully improved since then. As of December 2024, EM HY spread levels are also higher than the levels of both US (+76 bps) and EUR HY (+17 bps).

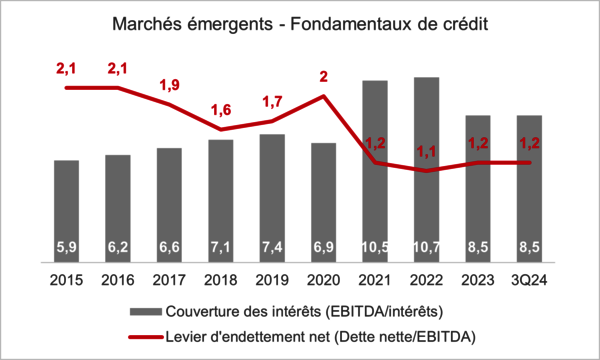

Looking at the chart below, we see that both net leverage and interest coverage metrics have been improving significantly since 2018, with more cautious capital structures and sound operating performance more than offsetting the rise in interest rates. EM HY fundamentals also compare well to both US and EUR HY.

Given the current spread levels, we would not bet on a broad spread tightening in 2025, but our positive outlook regarding credit fundamentals supports the case for resilience in spreads and we believe that we could even see some idiosyncratic tightening on compelling credit stories.

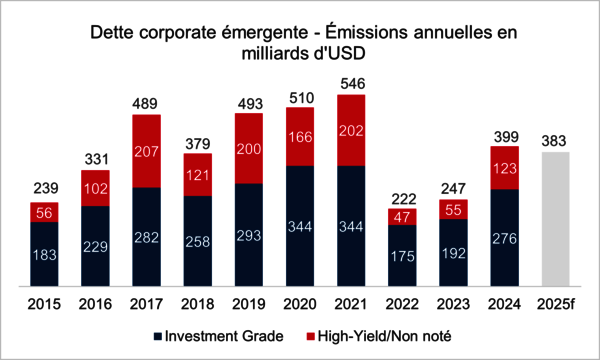

As such, the yield level looks even more attractive on a risk-adjusted basis, as we expect credit fundamentals to remain strong in 2025, with further normalizing access to primary markets for issuers, especially in the HY space – which saw a pick-up of 124% y/y in primary activity in 2024.

Some issuers should continue to capitalize on the positive structural reforms and improving macro conditions in large high-yield emerging countries like Argentina, Turkey or Nigeria.

As we are writing this, the national oil and gas company of Argentina YPF already successfully priced a new $1.1bn 2034 bond on January 8th. JP Morgan expects primary activity to remain around $400bn in 2025 for EM corporates (cf. below).

As a result, default rates are expected to remain low after normalizing in 2024 to 1.3% from 3.2% in 2023, largely below the 2.5% 10-year average of the CEMBI Broad Diversified HY. China still accounted for nearly half of defaults in 2024, with much lower expected recovery rates too.

For 2025, JP Morgan forecasts default rates to stand at 1.7%, still below the 10-year average. The combination of high carry and low expected default rates should continue to provide a floor to the asset class total return in 2025.

Default rates | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025f |

CEMBI BD HY | 2.3% | 4.5% | 1.6% | 0.7% | 1.6% | 4.0% | 3.4% | 2.8% | 3.2% | 1.3% | 1.7% |

Source: JP Morgan, Emerging Markets Corporate Strategy

Regionally, while both Asia and Middle-East spreads are already at their 10-year tights, Latin America and Emerging Europe – however distorted by the outlier of Ukraine – are still offering some pick-up compared with their 10-year tights.

Meanwhile in terms of regional fundamentals, Latin America stands out as the region where the market consensus expects more improvement on credit fundamentals, while Asia is the continent where more deteriorations are expected. We are overweight on Latin America, especially in the HY space where we still see compelling credit stories offering attractive risk-reward opportunities.

% of sectors, by count | Asia | CEEMEA | Latam |

Improving | 9% | 14% | 25% |

Deteriorating | 27% | 14% | 18% |

Stable | 52% | 52% | 43% |

Mixed trends | 12% | 21% | 14% |

Source: JP Morgan, Emerging Markets Corporate Strategy

III. Portfolio review and positioning for 2025

The yield of our fund increased from 8.8% in June (7.4% in euro) to 9.7% in December (8.0% in euro) while fundamentals have remained on an improving trend, especially for HY issuers.

Cash holdings of the fund rose from 5.5% to 9.5% of net assets in the last month of the year, as we received some inflow that we are not rushing to deploy, in anticipation of heavy primary market activity in early 2025 and some volatility post January 20th, when Trump executes (or not) on some of his controversial measures.

Duration remained quite short at around 3.6-3.8 years since the launch of the fund, while the CEMBI Broad Diversified index of JP Morgan stands at a duration of 4.2 years. Given the recent sell-off in rates, we are more comfortable with lengthening duration slightly to gradually position ourselves nearer to the CEMBI duration, using US Treasury futures instruments while keeping the credit duration of our bond portfolio quite short.

Our average credit rating stands at B+, where we see spreads remaining relatively attractive against historical average and against other credit rating buckets, especially when integrating expected improvements in fundamentals.

It is worth noting that a large share of our single-B or below single-B names is capped by the sovereign rating of the country where they operate, resulting in credit ratings that are lower than those indicated by their underlying credit fundamentals.

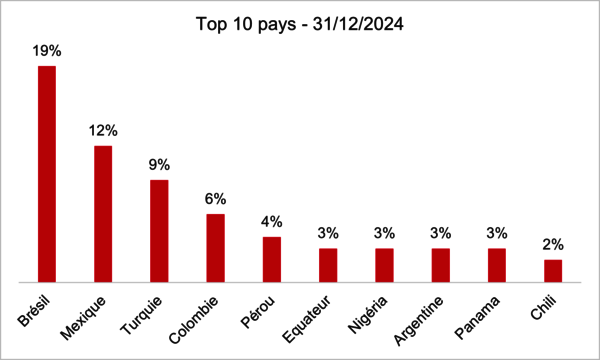

In terms of geographic exposure, we continue to favor Latin America (55% of our fund) as we see the region as the most compelling risk-return opportunity given current market valuations and our outlook on fundamentals.

We maintain a large exposure to Brazil (19%), and we even added a little bit of exposure in the December Brazilian sell-off as we deemed the impact on some strong export-oriented credits to be exaggerated. Our Brazilian exposure remains heavily skewed towards export-oriented companies that benefit from currency depreciation and are less exposed to domestic economic cycles.

We also maintain a high exposure to Mexico (12%), partly on restructuring stories (2.7%) and refinancing plays (3.6%) that we see as interesting risk-reward opportunities in the short-run and that have a low correlation to Mexican volatility. We also like Colombia (6%), where the sovereign-related premium remains very interesting while corporate fundamentals are firm.

2024 was also a year of significant improvement for the usual high-beta names of the last few years: following major political shifts, Argentina (3%), Turkey (9%) and Nigeria (3%) all achieved meaningful success in solving their macroeconomic imbalances, although some work remains to be done.

Ecuador (3%, where we hold our largest single-name exposure) also demonstrated stronger-than-expected results on the fiscal side and strengthened its external position under the new Noboa administration.

The sustainability of the country’s trajectory will likely depend on the incoming presidential and parliamentary elections, with the country likely to regain market access in the near future if a market-friendly result emerges and fiscal efforts are sustained. We remain cautious on our exposure to those countries, especially given the steep tightening of risk premia in those markets.

While we remain broadly constructive on the trajectory of those countries and keep monitoring the risk-reward opportunities there, we took some profits in Argentina where spreads tightened the most and reduced our exposure to exporters in Turkey on the back of the real appreciation of the currency in 2024 – which is pressuring their margins – to favor new issuers that are less exposed to this lira appreciation in real terms.

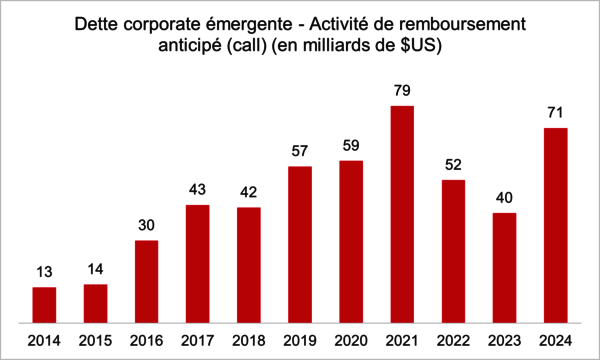

We also increased our exposure to short-term HY credits that present short-term refinancing/call possibilities, which proved to be a sound strategy to capture some upside in 2024.

Indeed, 2024 was the second highest year in terms of call volumes for EM corporates over the last 11 years, with $71bn-worth of bonds called. We estimated that given maturities looming in 2026-27 and the current spread levels, primary activity will be quite important in early-2025 and volumes of bonds called should remain firm.

We estimate that approximately 20% of our fund is positioned to capture those call/tender opportunities related to refinancings. As we speak, we already received two tender offers on those bonds, at a premium to market prices.

We are rather underweight on long duration IG bonds that offer historically low spreads (cf. above), while we prefer to manage our duration directly through US Treasury futures instruments.

Our long duration exposure (approx. 8-9% of the fund) consists mostly of strong credits that still offer interesting spreads for exogenous reasons, mostly related to sovereign risk premium. For instance, we maintain a 2.8% position on Ecopetrol’s long bonds in Colombia, which offer spreads of up to 520 bps on the 45s notes.

In the meantime, we continue to monitor and adjust our portfolio daily according to the main identified risks: we maintain a cautious duration management, as volatility remains high in rates and Trump’s policies introduce further uncertainty.

Regarding our exposure to geopolitical hotspots such as Ukraine, the Middle-East or even China, we hold rather conservative exposures as spreads have been tightening, and we are still waiting for clear resolution pathways.

As for country-specific risks in countries like Brazil and Mexico, mostly due to fiscal challenges and trade policy concerns, we remain prudent in our bond picking, focusing on issuers that are not (or the least) fundamentally affected by the consequences of such risks and that are offering sufficient premium given the perceived risk on the credit.

Overall, while 2025 is again likely to see some volatility events from different fronts, be it on rates or specific country/region risk premia, it is always a context that also brings nice opportunities for active managers.

The 2025 outlook for EM corporate bonds presents a compelling opportunity for income-focused investors. Despite tight spreads, strong fundamentals, call/tender activity and attractive carry provide room for selective gains.

By emphasizing short-term HY bonds and maintaining cautious positioning, investors can balance yield opportunities with potential risks. We believe that the fund remains well-positioned to capitalize on market dynamics while managing downside risks in a challenging yet promising environment.

Disclaimer

Please refer to the Key Information Document (KID)/prospectus before making any final investment decision.

This document is published by Axiom Alternative Investments and is intended for professional investors only.

The prospectus, KID, net asset values and annual reports of the funds are available from Axiom Alternative Investments - 39 avenue Pierre 1er de Serbie - 75008 Paris or on www.axiom-ai.com.

The risks and fees relating to the funds are described in the KID/prospectus.

Axiom Emerging Markets Corporate Bonds, sub-fund of AXIOM LUX, an open-ended investment company incorporated under the laws of the Grand Duchy of Luxembourg and complying with the UCITS Directive.

Investing in the funds involves a risk of capital loss.

This document has been produced for information purposes only. It does not constitute an offer to subscribe or investment advice. The information contained herein may be incomplete and is subject to change without notice.

The management company may decide to cease marketing in your country at any time. Investors can access a summary of their rights in English at axiom-ai.com/web/en/regulatory-information/.

No part of this document may be reproduced without the prior permission of Axiom Alternative Investments.

Axiom Alternative Investments, - 39 Avenue Pierre 1 er de Serbie, 75008 Paris - Tél : +33 (0) 1 44 69 43 90 Société à responsabilité limitée au capital de 1 001 500 euros - N° d'agrément AMF : GP-06000039

Main risks

Risk of loss of capital, discretionary management risk, equity risk, currency risk, portfolio concentration risk, counterparty risk, risk associated with commitments to financial derivative instruments, risk associated with subordinated debt securities, sustainability risk, legal risk.

SRI risk scale 3 out of 7 for the early investor share class AC EUR (LU2802104476). Recommended investment period: 3 years. SRI risk scale from 1 to 7, from the lowest risk level (which does not mean risk-free) to the highest. The score indicated combines market and credit risk, and may change over time.

SRI risk scale 3 out of 7 for the early investor share class AC USD (LU2821740730). Recommended investment period: 3 years. SRI risk scale from 1 to 7, from the lowest risk level (which does not mean risk-free) to the highest. The score indicated combines market and credit risk, and may change over time.