2024 has been a strong year for risky assets. The MSCI World and the Bloomberg Global High Yield returned respectively c. 17% and 11% in USD. Despite falling inflation and dovish central banks, duration underperformed as expectations of a strong nominal slowdown were disappointed. The Bloomberg Global Aggregate Index, USD hedged, returned only 3.40%, i.e. less than cash.

Looking to 2025, these levels of returns on global risk assets will be difficult to repeat. Inflation is no longer in a clear downtrend in developed countries and seems to be even reaccelerating in the US. Central banks may be forced to reverse course, challenging the monetary easing narrative that has supported markets so far. Trade and geopolitical tensions will remain elevated.

With valuations at the tights in many asset classes - the MSCI World trades at 20x earnings despite higher real rates and spreads have moved towards the lower end of their historical range - the potential for a risk premia reversal is material.

In generally expensive markets, European financials stand out by the level of yield they offer across subordinated credit and equities. In euro terms, the yield-to-worst at the AT1 index level stands at c. 6.6% despite a reduced extension risk. 40% of the 2025 redemptions have been already pre-refinanced and the remainder are generally high reset.

The sector credit upgrade trend is set to continue, with many names in positive outlook at the subordinated level. The technical picture looks strong as inflows into credit funds are likely to outpace a flat or even slightly negative net supply. Active credit managers will benefit from the plentiful off-benchmark and regulatory opportunities offered by the space.

On the European bank equities front, a 15% earnings yield, stable returns on equity and the scope to further boost long-term distributions through M&A and capital optimisation position the sector for a 5th year of outperformance. Investors should not overthink the risks to European rates and growth and focus instead on the sustainability of fundamentals:

NII will benefit from balance sheet duration, steeper curves, and growth in deposits. Sensitivity to the level of interest rates is still positive in aggregate but has been significantly reduced, sometimes by as much as 4 times, limiting the impact of the depth of the easing cycle on margins.

On the latter, we note that sticky services inflation and wages, ECB inflation projections above 2% despite optimistic productivity assumptions, and a fading impact of past restriction on deposit and lending growth, make a deep cutting cycle very unlikely.

Commissions will act as a counterbalancing weight to interest rates. If rates were to fall more than expected, lending, client flows and capital markets will expand by more than expected. Continued macro volatility will provide a tailwind to trading, especially in FICC.

Asset quality will be supported by better consumer real income in Europe, management overlays, and a stabilisation in the real estate sector.

Lower regulatory headwinds and a boost to securitizations will improve capital generation, supporting higher shareholder payouts.

Finally, M&A operations, whether bolt-on or large-scale, will help improve both the quality of the revenue mix (adding insurance, asset management and investment banking exposures) and the cost efficiency (by realizing synergies) of the sector.

I. The fundamentals of the European Financials look well insulated from macro gyrations. Double digit returns on equity are set to persist even if interest rates go as low as 1%.

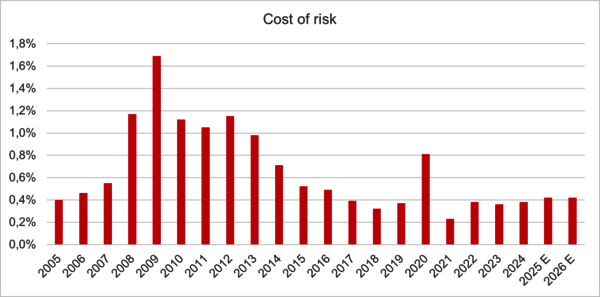

Current consensus expectations for banks in the Euro area are based on a 1.75% to 2.25% ECB landing rate, normalized deposit growth, weak GDP growth, some pick-up in commissions based on slightly better capital markets and lending activity, as well as a return to through-the-cycle average loan loss provisions.

All-in-all, it translates into very little change to the current ROE of the sector for 2025 and 2026.

2024 | 2025 | 2026 | |

Net interest margin | 1.71% | 1.65% | 1.68% |

Cost-income ratio | 53% | 54% | 53% |

Cost of risk | 0.38% | 0.42% | 0.42% |

CET1 ratio | 14.2% | 14.1% | 14.1% |

Return on equity | 12.0% | 11.5% | 11.7% |

Source: Bloomberg, Axiom Alternative Investments

Looking at sensitivities, fundamentals look well insulated from macro gyrations. The most discussed risk factor is a return to very low interest rates. Every 100bps parallel move in the interest rate curve is estimated to result in c. 10% lower earnings for the sector. Assuming interest rates at 1% across tenors (i.e. no benefits from a steeper curve), the sector ROE would still be in double digit territory before considering any offsetting impact of better commissions.

We detail our views below looking at the main P&L lines: NII, fees, loan losses and costs.

NII will benefit from repricing gaps, steeper curves, low deposit betas and better volumes

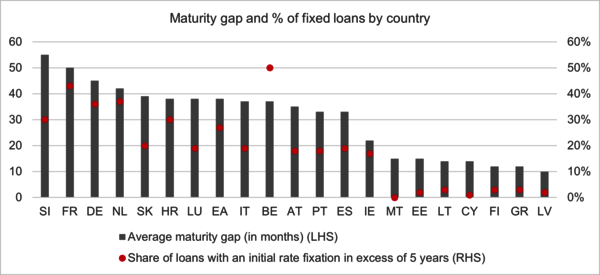

When projecting NII, the first step is to understand the repricing profile gap between assets and liabilities. Banks typically run a positive maturity gap, meaning that assets take longer to reprice than liabilities.

This gap varies significantly by type of institution and by country, resulting in very different NIM dynamics when interest rates move significantly.

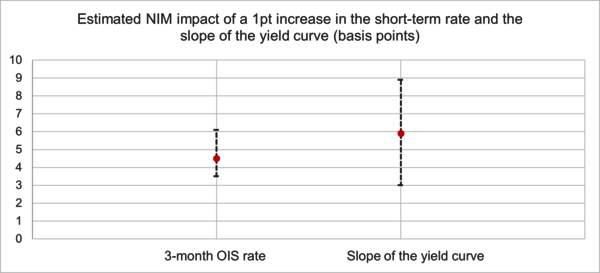

It explains why with falling short-term rates ahead, net interest margins will increase for certain banks and decrease for others. In the current environment, banks that run larger maturity gaps and are more sensitive to the slope of the yield curve rather than the level of short-term rates offer a more attractive revenue profile.

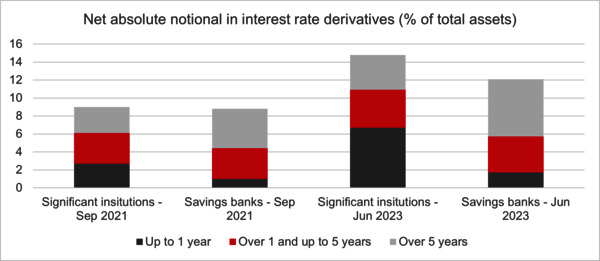

Importantly, banks have reduced their sensitivity to interest rates in the past two years, passively by having more term and rate-sensitive savings deposits on the liability side, actively by increase the size of receiver swaps.

To conclude on rate sensitivity, one must consider not only the sensitivity to the level of short-term rates but also to the steepness of the curve. Focusing only on the former would be a mistake as both variables are equally important for the NIM.

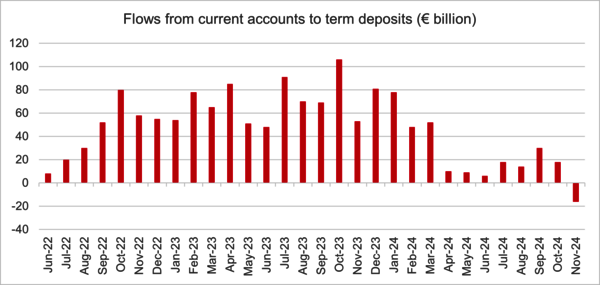

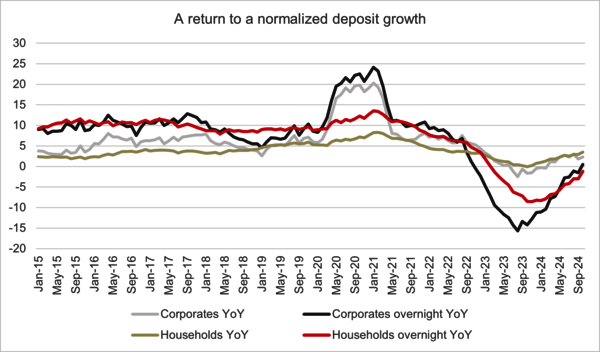

Another relevant factor to follow will be the “reverse beta”, i.e. the extent to which banks will be able to pass on rate cuts to deposits. Initial signs are encouraging. Term deposit rates have already fallen significantly since the peak reached at the end of 2023, decreasing at a speed of c.6-7 bps per month. Furthermore, customers are no longer shifting funds away from current accounts, as shown by the graph below.

On the volumes front, we expect deposit growth to stabilise at 3%-4%, with a stable mix between current, savings and term accounts. We are more pessimistic on loan growth despite the positive signs sent by the Bank Lending Surveys as we see higher for longer mortgage rates and a continued crowding out of private sector debt by public sector debt. All-in-all, we would expect loan growth to run at c. 1%, well-below nominal GDP growth.

The main risk for NII would be a return to sub-1% interest rates across the curve. We see this scenario as very remote. The policy decision framework of the ECB is helpful to understand why lowering rates even below 2% might prove difficult:

Domestic inflation data is still running well above target. Over 80% of the services basket display YoY inflation above 3%. Wages are growing above 3%, the level that would be consistent with a 2% inflation assuming normalized productivity gains.

ECB inflation projections show a GDP deflator at 2.1% in 2026 and 2027 and incorporate possibly optimistic assumptions on the productivity front.

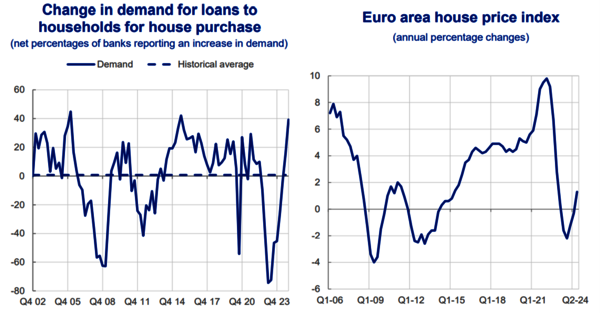

Improving bank lending surveys and rising real estate prices indicate that monetary policy may no longer be restrictive.

Asset gathering, wealth, capital markets and lending activity will boost commissions.

Commission volumes are a function of cyclical factors such as the overall economic activity, loan origination, FX and macro volatility, risk appetite and financing conditions, as well as structural factors such as demographics, regulation and new entrants.

Looking ahead, banks should benefit both from cyclical and structural factors across asset gathering and CIB, while the outlook par lending and payments is more mixed.

Asset gathering and wealth management

High saving ratios in Europe support flows into life insurance and mutual funds. Lower short-term rates reduce the appeal of term deposits and monetary market funds, and redirect appetite towards higher margins fixed income, equity and alternative funds.

Structural factors in wealth and private assets are supportive. Increased pressure on state pensions from an ageing population will accelerate the shift to “pillar 2” pensions, generating a new pool of inflows for the industry.

On the product factory side, banks are set to reinforce their partnership with private credit funds and grow commissions from origination, structuring and servicing. Finally, the rise of international wealth hubs in Asia and the Middle East will be beneficial for global banks such as HSBC and Standard Chartered.

CIB

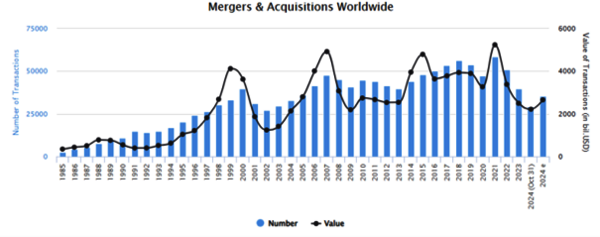

Trading activity has been running above trend since 2021 due to increased macro volatility and client repositioning. This is still the case as we write, with trading revenues across Equities and FICC set to be very strong again in Q4 2024. We do not foresee a material slowdown there as uncertainty remains elevated on the central bank policy path, tariffs and geopolitics.

On the contrary, capital markets activity has been negatively impacted by higher rates and volatility. There are reasonable hopes for a normalisation in ECM, DCM and M&A activity as market participants no longer defer investments on expectations of better rates in the future. Banks with US exposures should do better here, as “animal spirits” from a pro-corporate Republican agenda could accelerate the recovery.

Lending

The latest lending surveys show a notable rebound in corporate and household demand. One explanation is that participants are progressively getting used to the higher interest rate regime as a new normal. The table below shows the net percentages of banks reporting a tightening of credit standards or an increase in loan demand.

BLS survey as of Q3 24 (in %)

Entreprises | House purchase | Consumer credit | ||||

Credit standards | Demand | Credit standards | Demand | Credit standards | Demand | |

Euro area | 0 | 4 | -3 | 39 | 6 | 8 |

Germany | -3 | 13 | 7 | 44 | 15 | 26 |

Spain | 0 | 17 | 0 | 10 | 8 | 17 |

France | 0 | 8 | -22 | 67 | 8 | -15 |

Italy | 0 | -9 | 0 | 45 | 8 | 8 |

Source: ECB, Axiom Alternative Investments

Payments

One the one hand, FX volatility and tariffs should drive increased demand for cross-border flow solutions on the corporate side. On the other hand, fee pressure on international retail payments from regulators and Fintech competitors is still very much alive. We expect large wholesale banks to fare better than traditional retail banks in this area.

Overlays, SRTs, higher real wages, and a stabilisation in the construction and CRE sectors will ensure below-trend provisions

Loan loss provisions have been running at low levels for almost 10 years now. We expect this to continue. Capital and NPL regulations have pushed banks away from high-risk lending, lowering the level and volatility of defaults.

The private sector has been in deleveraging mode since the 2008 crisis, making it very resistant to changes in financing conditions. State-guaranteed loans have allowed banks to decrease their net exposure to the riskiest SME counterparties. Real wages are growing in Europe, supporting the solvency of consumers.

One area of concern has been real estate, and more specifically the business-district office and construction sectors.

Here loan losses are still relatively high but have been declining quarter over quarter as valuations are now fully adjusted. When challenged regarding their automative exposures, German banks do not expect notable developments in 2025.

Quarter | DB US CRE provisions per quarter |

Q3 22 | 40 |

Q4 22 | 26 |

Q1 23 | 35 |

Q2 23 | 74 |

Q3 23 | 66 |

Q4 23 | 123 |

Q1 24 | 121 |

Q2 24 | 130 |

Q3 24 | 68 |

Source : Deutsche Bank, Axiom Alternative Investments

Disciplined M&A will lead to improved cost-income ratios and better revenue diversification.

Banking M&A has picked-up across three dimensions:

Bolt-on deals to increase revenue diversification:

Banks have sought increased capital-light revenue streams through small and medium-sized acquisitions in diversified financial services.

Examples: DNB-Carnegie, BNP, Crédit Agricole

Insurance and asset management deals, using the Danish compromise:

The Danish compromise allows banks to use some sort of double leverage on their insurance activities. Banks have used this disposition to reinforce their insurance and asset management arms.

Examples: BNP-AXA-Agéas, Banco BPM-Anima, Allianz Global Investors

Consolidation deals aimed at extracting cost synergies:

2024 has been characterized by a return of bank M&A, helped by improving valuations and management confidence. Though European authorities have been supportive, local politicians have been more hesitant to give their backing due to a mix of competition and foreign interference fears.

Examples: Nationwide-Virgin, Coventry-TSB, Natwest-Tesco, BBVA-Sabadell, Unicredit-Commerz, Unicredit-Banco BPM

The success or failure of BBVA and Unicredit attempts to consolidate the sector will send a strong signal to investors regarding its investability.

II. Subordinated European financial credit offers many compelling carry and regulatory opportunities. At the asset class level, positive upgrades and strong technicals should support spreads.

Global credit currently resembles a “glass half full or half empty” story. Though spreads are historically tight versus sovereign benchmarks (especially in USD, less so in EUR), total yields are compelling.

Owing to large deficits, the supply of sovereign debt is increasing fast at a time when corporates are generally deleveraging. Spreads reflect not only risk appetite and growth expectations, but also the relative loss of appeal of sovereign debt versus corporate or financial debt in developed countries, both in terms of credit quality and supply/demand dynamics.

AT1s offer one of the best risk-rewards in the space thanks to a superior yield, a high and improving credit quality, reduced extension risk, and a strong supply/demand outlook.

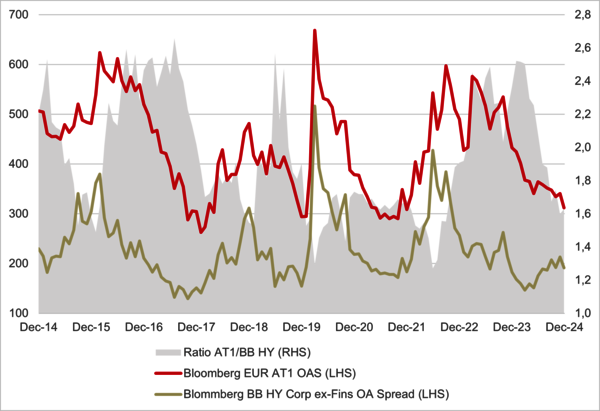

In euro terms, the yield-to-worst at the index level stands at c. 6.6%. In terms of spread, AT1s continue to offer a significant pick-up vs. corporate high yield instruments of the same credit quality. The spread ratio on the Euro AT1 index versus the Euro HY BB ex-Financials index is hovering around its long-term average of c. 1.5x.

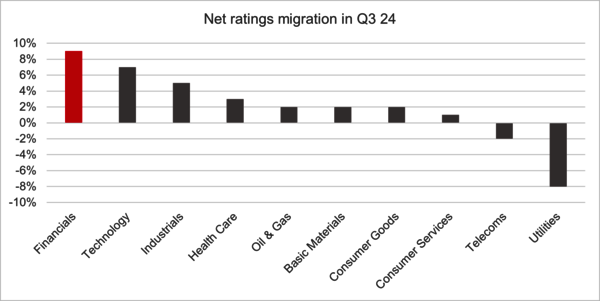

The credit quality trend is very strong, with many banks currently in “positive outlook” at rating agencies. This is both a reflection of the higher level of profitability across the sector and the progress achieved by periphery banks with their balance sheet cleaning. When looking only at the outlooks that could result in a rating crossing the investment grade boundary, the following names come to mind:

At the AT1 level, Santander, Standard Chartered, AIB, Bank of Ireland, ING, KBC and Swedbank.

At the Tier 2 level, Sabadell, Intesa, BCP, Novo Banco.

At the senior level, Unicaja, Monte, Iccrea, Eurobank, National Bank of Greece, Bank of Cyprus.

The only fly in the ointment is the negative trend at French banks. Moody’s downgrade of France sovereign from Aa2 to Aa3 in December resulted in a mechanic downgrade of the senior preferred rating at French banks on the back of weaker government support capacity. However, the subordinated ratings were unchanged. Here we note that Societe Generale is still in “negative outlook” at Moody’s due to its persistently low profitability.

2025 seems quite benign in terms of extension risk. Over 40% of redemptions have already been refinanced, including the tightest resets such as the € NDAFH 3.5% 25, the € CCBGBB 3.625% 25, the $ SEB 5.125 25 or the € KBC 4.25 25. Those AT1s with a 2025 call that haven’t been refinanced already all have resets above 400 bps, except for the € RBIAV 8.659 25, which will be arguably the one to watch.

We believe that the increased recourse from banks to tenders subject to new issues well before the first call date, even when bonds have resets below the refinancing spread, lowers the overall extension risk in the asset class and should result in tighter spread going forward.

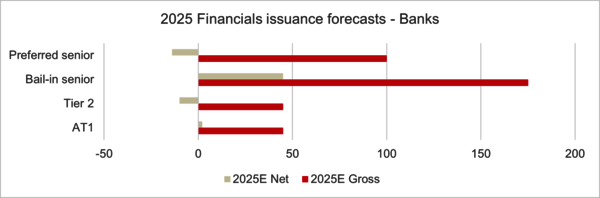

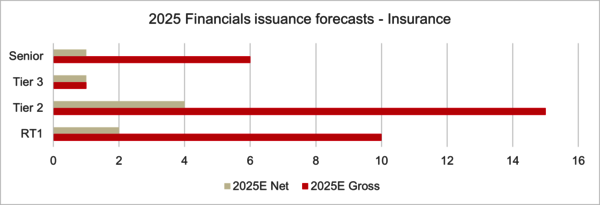

On the supply front, 2025 is set to be supportive, with an expected negative net supply in Tier 2s and a small positive supply in AT1s against of backdrop of continued inflows into fixed income funds as short-term rates come down.

Though we are generally constructive on AT1s for the reasons highlighted above, we believe the best opportunities lie away from the largest systemic banks’ issues. We find that the European financial credit universe is rich with diversifying, liquid and highly rated off-benchmark opportunities.

We show below that through bond selection it is possible to achieve higher spreads, higher resets, and lower volatility for a similar rating to the AT1 index, all while keeping an excellent liquidity profile.

Spread to call (bps) | Reset (bps) | Rating | Coco index beta | |

Coco index | 285 | 460 | BB+ | 100% |

Axiom Obligataire - AT1 bucket | 435 | 593 | BB+ | 86% |

Source: Axiom Alternative Investments

Liquidity | D1 | D2 | D3 | D4 | D5 |

Axiom Obligataire | 74% | 16% | 7% | 2% | 1% |

Source: Axiom Alternative Investments

Finally, regulatory developments continue to provide many trading opportunities. The pressure from regulators to address “infection risk” (i.e. when instruments with identical ranking in resolution but different capital value coexist) has intensified. On the 20th of December, the EBA published its response to a question regarding BFCM legacy Tier 1 instruments, providing very clear language on infection risk:

“While the instruments have been rightfully disqualified from all layers of capital and eligible liabilities under applicable grandfathering provisions, they still rank pari passu with fully eligible own funds instruments, creating undue complexity within the balance sheet of the issuer and raising concerns in terms of ranking. Therefore, it is the EBA’s view that BFCM should target the redemption of these instruments.”

In the UK, the Bank of England published a statement of policy confirming the power of the regulator to order the removal of instruments that cause impediments to resolution.

On the insurance front, the European Union adopted a transposition of the Banking resolution directive, which will put pressure on issuers to redeem instruments with infection risk:

"Member States shall ensure that all claims resulting from own-fund items have, in national laws governing normal insolvency proceedings, a lower priority ranking than any claim that does not result from an own-fund item."

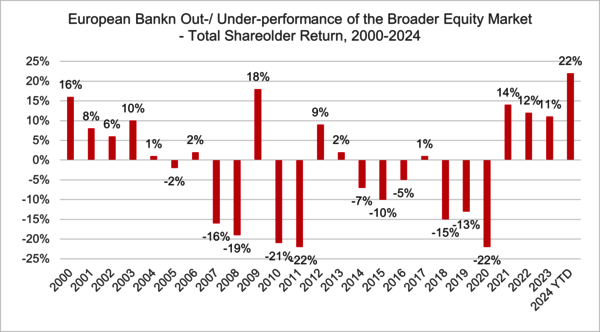

III. A favourable market configuration and further gains in long-term distribution capacity set European financial equities for a 5th year of outperformance.

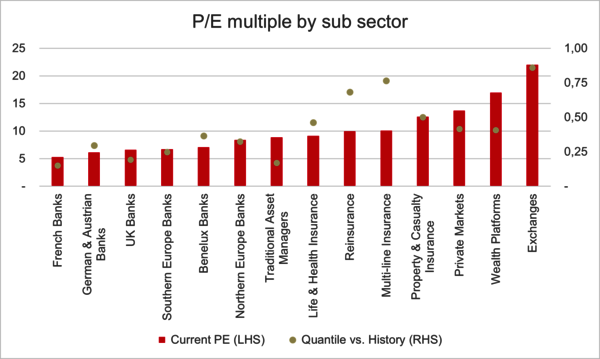

After a difficult post-crisis decade, European banks have outperformed the broader equity market for a fourth year in a row. The cumulative ~90% outperformance since the end of 2020 is impressive. It has all been driven by earnings revisions and carry. European banks remain downright cheap as illustrated by their record discounts to both the broader European market and their US counterparts.

As shown in part I, the earnings base is solid. Though rate curve sensitivity may be one reason why investors are hesitant to take the current earnings of the sector at face value, we find that argument contradicted by the relative pricing of rate-sensitive versus rate-insensitive banks. French and German banks are indeed among the lowest P/E banks despite their limited sensitivity to the level of rates.

We believe instead that the discount is largely attributable to low expectations regarding Europe and a low appetite to own stocks perceived to be highly sensitive to European political or macro developments.

This “low expectations” set-up is generally conducive to outperformance. There are some headwinds to growth in 2025, namely fiscal consolidation in France – if a budget is adopted - and in Italy, where the Superbonus scheme is being scaled back. There are also concerns around the impact of increased tariffs from a Trump administration.

On that front, models show diverging outcomes depending on whether countries retaliate and how fast trade flows are reconfigured. Contrary to popular belief, many models show a more negative GDP impact of a universal 10% Trump tariff for the US than for Europe.

There are numerous tailwinds as well. Consumer confidence is slowly improving on the back of moderating inflation and a continued catch-up in real wages. Bank lending surveys point to a rebound in residential and corporate investment. Lower short-term rates should lead to a decline in the household financial saving ratio, which is currently 4 to 5 pts higher than its pre-Covid level.

A faster disbursement of NGEU funds should help countries like Spain and Greece. Elections in Germany could bring renewed confidence and a boost to investment spending. All-in-all, we fail to see a doom and gloom scenario for the European economy.

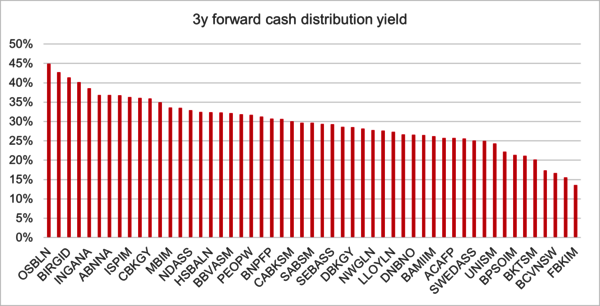

Going back to sector fundamentals, one key attraction of the sector is the double-digit distribution yield. More favourable regulatory winds, high capital buffers and a focus on ROE rather than topline growth should boost banks’ capacity to return capital to shareholders while funding growth.

The increased recourse to securitizations in recent months is a case in point. Regarding the inorganic growth versus distribution debate, we think management teams will only consider M&A if it is more accretive to EPS and DPS than doing buybacks.

The two drivers of European banks’ outperformance over the past 4 years, i.e. a normalized interest rate regime and a reversal in the regulatory cycle, are far from being fully reflected in stock prices.

On the latter, we would highlight the letter from the German, French and Italian Finance Ministries to the Commission, asking to “put stronger emphasis on the competitiveness of the financial sector, particularly banking, and its capacity to finance the economy”.

On the six following topics, competitiveness of investment banking (Fundamental Review of the Trading Book - FRTB), real estate financing, securitisation (financing the economy), climate risk (more realistic approach), macroprudential rules (application to be considered considering the competitiveness of the sector), improving the functioning of banking supervision.

The Ministries are pushing for a more practical and industry-friendly approach. The shift in the political and regulatory paradigm is a positive factor for the sector's profitability and growth.

Disclaimer

Please refer to the Key Information Document (KID)/prospectus before making any final investment decision.

This document is published by Axiom Alternative Investments and is intended for professional investors only.

The prospectus, KID, net asset values and annual reports of the funds are available from Axiom Alternative Investments - 39 avenue Pierre 1er de Serbie - 75008 Paris or on www.axiom-ai.com.

The risks and fees relating to the funds are described in the KID/prospectus.

Axiom Obligataire, sub-fund of AXIOM LUX, an open-ended investment company incorporated under the laws of the Grand Duchy of Luxembourg and complying with the UCITS Directive.

Investing in the funds involves a risk of capital loss.

This document has been produced for information purposes only. It does not constitute an offer to subscribe or investment advice. The information contained herein may be incomplete and is subject to change without notice.

The management company may decide to cease marketing in your country at any time. Investors can access a summary of their rights in English at axiom-ai.com/web/en/regulatory-information/.

No part of this document may be reproduced without the prior permission of Axiom Alternative Investments.

Axiom Alternative Investments, - 39 Avenue Pierre 1 er de Serbie, 75008 Paris - Tél : +33 (0) 1 44 69 43 90 Société à responsabilité limitée au capital de 1 001 500 euros - N° d'agrément AMF : GP-06000039

Main risks

Risk of loss of capital, discretionary management risk, equity risk, currency risk, portfolio concentration risk, counterparty risk, risk associated with commitments to financial derivative instruments, risk associated with subordinated debt securities, sustainability risk, legal risk.

SRI risk scale 2 out of 7 for the share class HC EUR (LU1876460731). Recommended investment period: 3 years. SRI risk scale from 1 to 7, from the lowest risk level (which does not mean risk-free) to the highest. The score indicated combines market and credit risk, and may change over time.