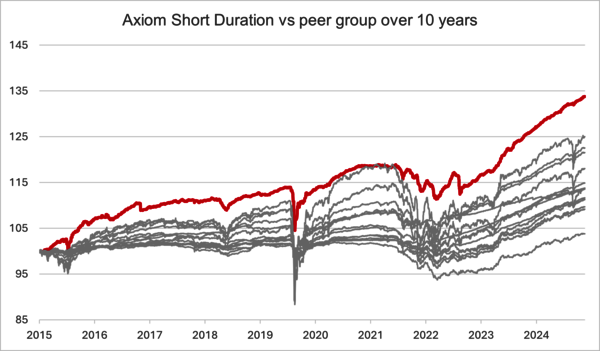

Axiom Short Duration has been supporting investors seeking the best risk / return profile for their core portfolio allocation, and has been a core strategy in Axiom Alternative Investments' product range, since 2015.

Thanks to the returns offered by financial bonds compared to non-financial corporate bonds with the same rating, Axiom Short Duration is leading its peer group with an annual performance of 2.971 since inception and has €462 million in assets under management.

Data as of 06/27/2025 | Source : Bloomberg, Axiom Alternative Investments | Net of fees cumulated performance since 06/26/2015 | The funds compared are selected primarily on the basis of the following criterion: short duration strategy | Past performance is not an indication of future performance.

Adrian Paturle, portfolio manager of Axiom Short Duration, commented:

“‘Leveraging Axiom Alternative Investments' areas of expertise, Axiom Short Duration has successfully navigated market turmoil over the past decade and has outpferformed the market. Axiom Alternative Investments will continue to optimise its carry2 strategy and allocation focused on financial bonds to provide the best outcome for holders of the fund.”

Calendar performance (net of fees)1 | |||||||||

2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Axiom Short Duration Bond Fund – HC EUR | 4.89% | -3.01% | -1.25% | 4.03% | 2.26% | 1.93% | -3.62% | 5.98% | 7.73% |

Benchmark (€ster + 2%)3 | - | - | - | - | - | - | 2,03% | 5,44% | 5,90% |

1 Past performance is not an indication of future performance.

2 Carry refers to the return an investor earns from holding a bond over time, assuming no change in interest rates or credit spreads.

3 Since 12/20/2021.

About AXIOM Alternative Investments :

Founded in 2009, Axiom Alternative Investments is an independent management company based in Paris, Geneva, Milan and London via its subsidiary AXM Alternative Investments. The company currently manages 3.3 billion euros (as of 06/27/2025) through a range of UCITS funds and dedicated mandates. These investment vehicles are marketed in Europe to institutional clients, family offices, private banks and wealth management advisors.

Fees structure HC EUR share class - LU1876459725 : entry costs: 2% max. (not charged by the management company) | Exit costs: 2% max. (not charged by the management company) | Management fees, other administrative fees and operating costs: 1.16% | Portfolio transaction cost : 0.23% | Performance fees: 0%

Main risks – Please refer to the KID or prospectus for more information

Risk of capital loss, risk associated with discretionary management, credit risk, default risk, exchange risk, risk associated with portfolio concentration, counterparty risk, risk associated with commitment to derivatives, risk associated with subordinated debt securities, sustainability risk, legal risk.

SRI risk scale 2 out of 7 for the HC EUR share class (LU1876459725). Recommended investment period : 3 years. SRI risk scale from 1 to 7, from the lowest risk level (which does not mean risk-free) to the highest. The score indicated combines market and credit risk, and may change over time.

Disclaimer

Marketing communication. Please refer to the prospectus and the key information document (KID) before making any final investment decision. This document is published by Axiom Alternative Investments, a French asset management company registered with the AMF under no. GP-06000039. It does not constitute an offer to subscribe or investment advice. The information contained herein may be incomplete and is subject to change without notice.

The prospectuses, KID, net asset values and annual reports of the funds are available from Axiom Alternative Investments or on www.axiom-ai.com. The risks and charges relating to the funds are described in the KID/prospectus. Axiom Short Duration Bond Fund is a sub-fund of AXIOM LUX, an open-ended investment company with variable capital governed by Luxembourg law and complying with the UCITS Directive.

The management company may decide at any time to cease marketing in your country. Investors can access a summary of their rights in English at the following link https://axiom-ai.com/web/en/regulatory-information/

The prospectus for Switzerland, the key investor information document, the semi-annual and annual reports and other information can be obtained free of charge from the Swiss representative and the fund's paying agent: CACEIS, Montrouge, branch in Nyon/Switzerland, SA, Route de Signy 35, CH-1260 Nyon.

Reproduction in whole or in part is prohibited without the prior permission of Axiom Alternative Investments.

Press contact | ||

France | LTV Communication | Laura Teboulle-Vassen laurateboulle@ltvcommunication.com +33(0)7 86 71 71 36 |

Switzerland | VOXIA | Laura Lapreta and Nicole Nussbaumer +41 79 311 89 04 |

Italy | VERINI & ASSOCIATI | Maria Pia Quaglia +39.348.7607103 |

UK | MHP Group | Hugo Harris +44 (0) 7557 741 217 |