1. Outcome of the elections

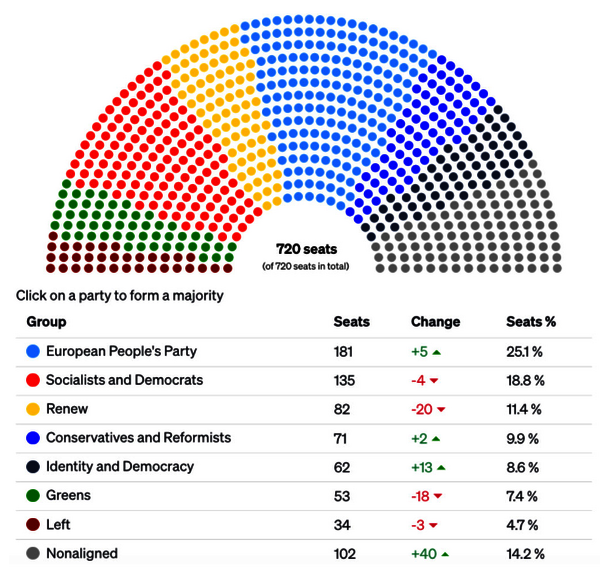

EU elections went more or less according to the polls: a far-right push in bigger countries (AFD in Germany, RN in France, FdI in Italy) but overall, a Parliament where the current majority coalition has enough votes to carry on and the EPP is unlikely to create an alternative coalition with other right-wing parties.

Expect some political shenanigans around the next EC President, expect some minor policy shifts (maybe less green transition and more defense and security), but overall do not expect big changes in EC and EP policies.

The biggest shocker came from France, where President Macron decided to call for new Parliamentary elections ahead of the ones scheduled in 2027, after Mrs. Le Pen’s RN party scored a big win (31.4%).

2. Why did Mr. Macron call general elections?

Very few people expected or even mentioned the possibility of early elections, so finding a single explanation for Mr. Macron’s choice might seem a bit futile. As an ex-post rationalization, however, we would point out the following.

French public finances are in a difficult spot after the S&P downgrade and poor tax collections. The budget law to be voted in the fall is going to be a very difficult one and there was a possibility that Macron’s government would have collapsed anyway. It’s always better to call early elections on your own terms.

Macron’s non-RN opponents are in a difficult situation:

Moderate parties could be forced to ally with him in order to block a Le Pen / Bardella government; this would weaken their prospects for 2027.

Mr. Mélenchon’s party (LFI -10% yesterday) is in a weaker position than in 2022, and there is a possibility that his 2022 allies (PS) choose to run separately this time and weaken him further ahead of 2027. The good score of PS yesterday reinforces this scenario.

Maybe, Mr. Macron believes that Mr. Mélenchon is the real opponent for 2027: if Le Pen in the 2nd round is considered a given, the risk for Macron’s heir is simply not to be in the 2nd round at all.

Even if Mr. Macron’s calculations backfires and RN wins an absolute majority in Parliament, there is a possibility that Mrs. Le Pen or Mr. Bardella handle the country badly enough that it reduces their prospects of winning in 2027.

3. What are the political and financial consequences?

What are the various possibilities France is facing over the next few months and the possible market impacts?

Scenario 1: Mr. Macron muddles through

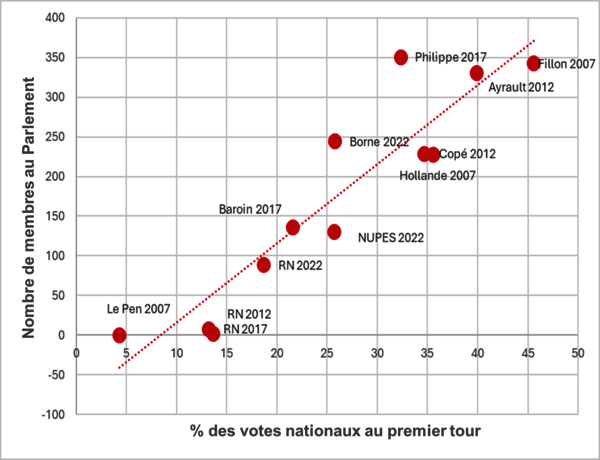

French parliamentary elections do not work with a first-past-the post system but with what are effectively 579 two-round elections. This means that local alliances and political history play a large role in the outcome. It is very hard to translate a share of national votes into number of MPs and the relationship is not linear as the chart below shows.

Under that scenario, Mr. Macron’s strategy would work, as moderate parties would agree to join his government to block the RN – which would be the largest party in Parliament. Do not expect important reforms but do not expect any significant economic or political shock either.

Scenario 2 – the 4th Republic is back

Under that second scenario – which chronologically could follow the first one, or vice versa – France would move from one unstable coalition to another, with a weak Parliament, short-lived governments and little would be achieved. However, one should remember that approximately 80% of new legislation in France is simply transposing European legislation – which is mostly binding anyway. Major European projects, such as the capital market union or the achievement of the banking union, would probably be stalled, but we do not think investors put too much money on them anyway. France would have to learn to live a bit more like the Netherlands, where coalitions take months to form!

Scenario 3 – RN wins an outright majority

If Mrs. Le Pen’s party wins an outright majority – which we think is unlikely, maybe 20% odds - the markets’ reactions will mostly depend on the economic program of the new government. It should be stressed that Mrs. Le Pen has long abandoned her most radical policies, such as leaving the Euro, for which a referendum would be necessary anyway.

With the risk of grossly oversimplifying a complex environment, we see two “sub-scenarios” there.

The “Meloni” approach – which both Mr. Macron and Mrs. Le Pen are certainly very aware of. Although she initially spooked markets, Mrs. Meloni’s first year and a half in office has been a success on some key aspects: she managed to keep good relationships with other EU countries, did not introduce radical or unsettling economic policies and won the EU elections comfortably. She could be a blueprint for a RN party looking to win the 2027 presidential elections. The point here is obviously not to support or attack Mrs. Meloni’s politics, but merely to point out that, from a markets point of view, her term in office has been uneventful so far.

The radical approach – the main difference between Mrs. Meloni and Mrs. Le Pen is their economic program. Even though details of her program remain somewhat unclear, we think it is fair to say that Mrs. Le Pen is economically more left wing. She supports more public investments, backpedaling on the pension reform, financial speculation taxes, etc. From a market’s point of view, the main risk would thus be that she engages into massive public spending that could jeopardize French public deficit targets and create a rift with Germany or other EU countries. We do not think such a position would be tenable very long (as Mrs. Truss can testify) but it is clearly the bear case for markets.

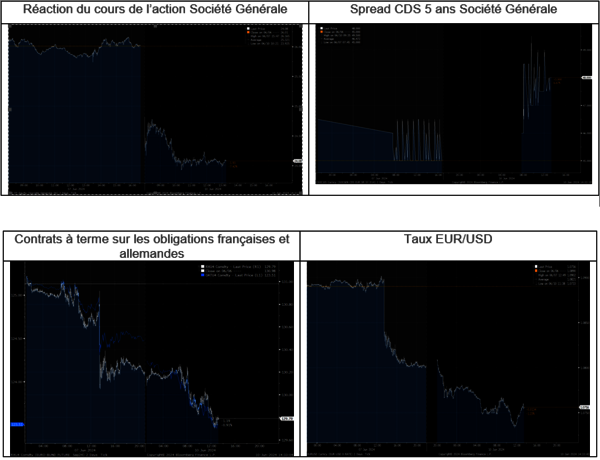

From banks’ point of view, all this has only very indirect impacts. An OAT credit event remains an exceptionally unlikely scenario and banks’ recent strong performance is mostly driven by the seismic shift in monetary policy since 2022. As the charts below show, shares of French banks were hit hardest – but isn’t it always the case when there is some sort of systemic or political event, even with no consequences on profitability?

We think the market’s reaction on other asset classes is more relevant and shows that investors are largely relaxed about the next developments. Bank CDS have barely moved and French – German bond futures did not diverge.

The next step will be French opinion polls – this will give a preliminary indication on the most likely scenario and the odds of RN achieving an outright majority.